Refiners are struggling to keep up with demand, prices have increased dramatically over the past few years, and debate is raging over depleting federal reserves. If you think the subject is oil, think again. Helium, the most important supercoolant used in science, is experiencing much of the same market volatility.

During 2007, a worldwide shortage of helium was big news, the result of a “perfect storm” of supply problems that included plant shutdowns, delays in new plants coming online and restrictions on withdrawals from the government’s pipeline.

Helium, the second most abundant element in the universe, was first discovered in our sun, where it is the product of nuclear fusion. On Earth, helium is a byproduct of radioactive decay underground and must be extracted during natural gas production. Image courtesy of NASA.

As worldwide demand for helium grows and concerns about adequate supplies increase, some again question the wisdom of selling off the government’s stockpile, accumulated over the past four decades. With tight supplies have come higher prices, and some major helium users are turning to conservation methods to keep their budgets from soaring and their gas supply from drifting up, up and away.

It’s a gas, gas, gas

Helium’s abundance in the universe is second only to hydrogen. It was first discovered in our sun, which, as it ages, collects the gas, the product of nuclear fusion, in its center.

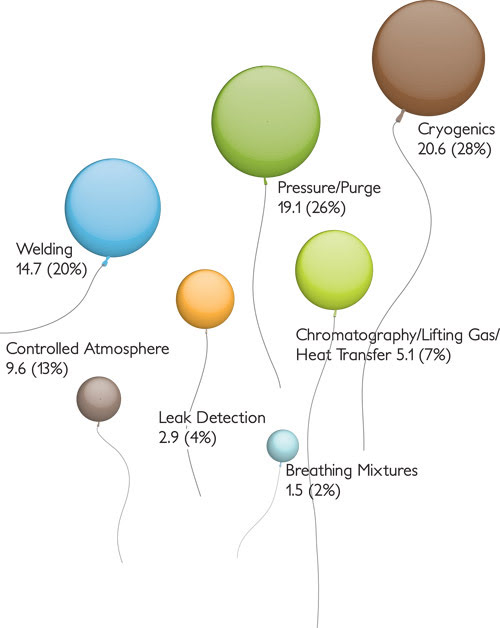

This illustrates US helium consumption, by end use,in 2007. Units, which total 73.5, indicate million cubic meters. Source: US Geological Survey Minerals Yearbook 2007.

The Earth’s atmosphere contains helium, but in such tiny concentrations it would be prohibitively expensive to recover. So our helium, whether used to lift a blimp or cool magnets in an atom smasher, is harvested as a byproduct of natural gas production.

As a noble gas, helium is chemically inert, meaning that it doesn’t want to combine with other elements. It also is radiologically inert and won’t become radioactive.

And because its boiling point – when it moves from a gaseous to a liquid state – is near absolute zero, helium has no equal for cryogenic applications. Helium liquefies at 4.2 K (–452 °F), a temperature not found naturally anywhere in our solar system, even on Pluto (–391 °F).

Scientists have just begun to explore the fascinating properties of helium when it is cooled further. At 2.17 K (–455.76 °F), helium becomes a superfluid that can flow unhampered by any viscosity whatsoever. It even flows up.

Earth’s supply of recoverable helium, the result of radioactive decay, is finite and irreplaceable. Because it is lighter than air, if not extracted when natural gas is pumped from underground, it simply floats away, eventually moving out of our atmosphere and into outer space.

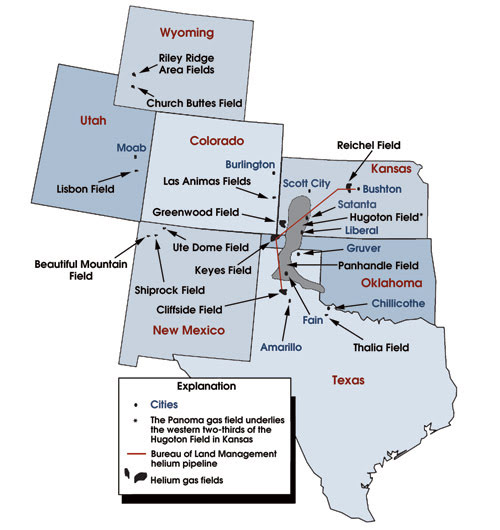

Arrows point to sites of major US helium-bearing natural gas fields. Source: USGS Minerals Yearbook 2007.

Washington University in St. Louis chemistry and physics professor Dr. Lee G. Sobotka sounded the alarm about helium in a university publication in December 2007 and urged industry to focus more on recycling and conservation.

“When we use what has been made over the approximate 4.5 billions of years the Earth has been around, we will run out,” he said. “The government had the good vision to store helium, and the question now is: Will industry have the vision to capture it when extracting natural gas, and consumers the wisdom to capture and recycle?”

I just want to pump … you up

Although all natural gas contains helium, it usually is not in sufficient quantities to make it worthwhile to extract, and the gas is distilled from only a small percentage of the natural gas extracted from the ground. If not captured, the colorless, odorless lightweight helium drifts away when the natural gas is burned.

In the US, purified helium is commercially recovered from natural gas deposits, mostly in Texas, Oklahoma and Kansas. (For a time line of the helium industry in the US, see www.photonics.com.) Some of the richest resources are under the Texas Panhandle; there also are helium extraction operations in Colorado, Utah and Wyoming.

The US Department of the Interior’s Bureau of Land Management (BLM) provides crude helium to refiners via a 424-mile pipeline and regulates how much they can withdraw.

Only 15 commercial plants worldwide have the ability to separate helium from other gases and to purify it. Levels of helium considered worthwhile typically average about 0.2 or 0.3 percent (1 percent is considered high), and some of the gas is inevitably and irretrievably lost during the extraction process.

Because helium stays gaseous at temperatures that liquefy the other compounds in natural gas, cryogenic extraction methods can be used. When it is supercooled, the other components turn to liquid and are drained off. The other method, pressure swing absorption, uses molecular sieves to separate helium from other gases.

Crude helium usually contains between 50 and 80 percent helium and must be further distilled to achieve Grade A standards (99.995 percent or greater purity, required for atom smashers and other high-tech uses). US exports of Grade A helium increased by more than 20 percent in 2006.

The Federal Helium Reserve is in a geologic structure known as the Bush Dome (named after the man who once owned the land, not either president). It holds billions of cubic feet of natural gas containing varying amounts of helium.

Crude gas from the reserve is sent to a BLM-owned facility, which enriches it to about 80 percent helium and adds it to the pipeline for delivery to 10 privately owned crude helium plants and six pure helium refineries. About 2 billion cubic feet are removed from the reserve each year, meeting about 42 percent of domestic demand and 35 percent of global helium needs.

Just as in the oil industry, problems at the refinery level have had a major impact on the helium market over the past few years.

In 2006, two of the 21 privately owned domestic crude helium plants did not produce or extract helium at all, according to the US Geological Survey. In 2007, a new plant in Algeria ramped up production later than expected and at half the expected capacity, a plant in Qatar came online slower than expected, and problems at the ExxonMobil Corp. plant in Shute Creek, Wyo., the world’s largest source of commercial helium, left it operating below capacity.

Worldwide production capacity of helium, excluding the US, was about 1.7 billion cubic feet. In 2006, all helium produced outside the US came from Algeria, Poland, Qatar and Russia.

By mid-2007, many complaints about rising costs and tight supplies aired in the media, from physicists and other researchers to party supply store managers. The wisdom of selling off most of the federal reserve, which has served as a buffer to industry shortfalls, again was questioned.

Sponsored by the US Department of the Interior, the National Research Council once again has set up a committee to explore whether selling the reserve is a good idea.

Selling crude helium from the reserve is a good thing, according to Phil Kornbluth, executive vice president of Matheson Tri-Gas Global Helium in Basking Ridge, N.J.

“I think it makes good sense. If it wasn’t being sold, there would be a tremendous worldwide helium shortage,” he said, adding that about 30 percent of the helium sold on the market now is coming from the stockpile.

Kornbluth said that the shortage, which began in April 2006, “fizzled out” at the end of last year because, “for the first time in a while, all of the world’s helium plants were running.” He also noted that, as is true with most commodities, when the price goes up, demand tends to go down.

“This year has been way better than 2007 and 2006 so far. The market is still tight, still vulnerable to shortages if things go wrong, and will probably remain vulnerable to shortages through 2010,” he said. Planned maintenance shutdowns in particular can have an adverse effect on the market if longer than originally planned.

Still, he said, “There’s lots of helium in the world and lots of natural gas. There’s no shortage of molecules, only production capacity.”

Complicating discussions about the helium program are the recent findings of a “questionable” relationship between the BLM and refiners.

After an investigation triggered by a whistleblower, the Department of the Interior’s inspector general issued a report in August stating that the BLM improperly issued two 15-year sweetheart deals with a helium storage contractor that could cost the government more than $100 million by 2015. The agreements allow the contractor to overcharge the government and to more than double actual equipment costs, to double-bill the BLM, and to use tens of thousands of federal dollars as short-term loans.

To enter into the agreements, all four refiners on the helium pipeline acted together to create a shell company, Inspector General Earl E. Devaney said in his report. He also found that BLM field staff established annual budgets in private meetings with helium refiners and adjusted overhead rates to decrease refiners’ costs.

The report recommended that the department thoroughly review all agreement costs and eliminate double-billing and other inappropriate payments.

Helium supply: Looking up?

Several new plants scheduled to come online in the next few years could ease supply tensions.

Matheson Tri-Gas and its partner, Air Products, are building a helium plant in Wyoming to produce 400 million cubic feet at full capacity. The facility will get its feed gas from a $100 million natural gas processing plant at Riley Ridge, Wyo., that will be built by Denver-based Cimarex Energy Co.

The Linde Group, which operates a helium refining facility in Otis, Kan., announced in July 2008 that its Australian subsidiary, BOC, had begun construction on Australia’s first helium plant, expected to produce some 150 million cubic feet of helium a year (about 3 percent of global demand).

The first helium extraction pilot plant recently was inaugurated in India, a country that, until now, had been entirely dependent on helium imports.

In the future, much of the helium produced will be a byproduct of LNG (liquefied natural gas) production, Kornbluth said. “When you build an LNG plant, you’re spending multibillions of dollars. A helium plant might cost $100 million. You can’t make the $100 million investment until someone makes billions of dollars of investment in LNG production first.”

Options also are being explored for substituting helium with cheaper, more readily available gases. Although there is no substitute for helium in cryogenics, argon can be used in its place for welding. Hydrogen is being investigated as a substitute for helium in diving applications below 1000 feet and to add lift to balloons, but it has the drawback of being flammable.

Coming around again

Some large users of helium, skittish about continuing supply concerns, are trying to take more control of their gas supplies and ballooning budgets. But helium recycling is not easy or even possible for every user.

NASA’s space program uses large amounts of helium to pressurize liquid fuel rockets, with the space shuttle reportedly requiring a million cubic feet at every launch, helium that can’t be recovered.

In 2007, in response to continued tight supplies, Macy’s and its helium supplier, Linde, made their first attempt at reclaiming some of the 300,000 cubic feet of the gas used in the store’s Thanksgiving parade balloons.

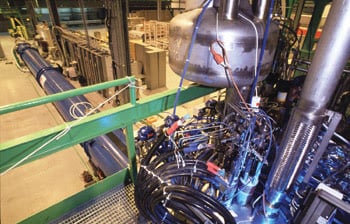

The magnets in the LHC will be cooled to 1.9 K (–270.3 °C). Keeping this 27-km-long machine at such a low temperature requires one of the largest refrigeration systems in the world. Pictured is the cryogenics plant in the testing area. Image ©CERN.

Smashing protons moving at the speed of light requires heavy-duty cryogenics at CERN’s Large Hadron Collider near Geneva. The gigantic particle collider’s more than 9000 magnets require 120 tons of helium to keep them at operating temperature. During normal operation, the helium circulates in closed refrigeration loops, but a certain percentage still will escape, whether through leaks, power outages or during a magnet “quench,” when the magnet warms up enough to lose its superconducting properties. Then the tremendous stored energy is released as heat, causing the liquid helium to boil off and escape.

A welder works on the interconnection between two of the Large Hadron Collider’s superconducting magnet systems in the LHC tunnel. Liquid helium cools the magnets so that they become superconducting. Image ©CERN.

“Applications that work well for recovery are those with a high volume of helium consumption, relatively few usage points where you have the ability to collect the waste helium, and where it doesn’t get contaminated with impurities that are difficult to remove,” such as leak detection, Kornbluth said.

“The rate of uptake by folks who use helium is probably less than it should be; we sell a modest number of recovery systems a year. But high prices mean more demand for recovery and recycling,” he added.

Recovery rates on fiber optic draw towers can be about 85 percent, he said. Optical fiber production is an excellent application for helium recovery because the fiber strands will cool even if the helium is not extremely pure.

“Contamination with gases used in electronics manufacturing makes it much more difficult to clean up. The semiconductor industry typically doesn’t recover helium, and it’s a big user,” he said.

Still, helium price increases and industry pressures to keep chip prices low have meant “increased interest for helium recovery from that industry. They’re trying to cut costs, and so they have to use helium more intelligently,” he said.

One of the Magnet Lab’s three helium recovery bags, high-tech recycling bins for helium, is ready to be re-cooled. Each bag holds about 2700 cubic feet of helium in gas form. From that huge space, the lab squeezes the gas into about 100 liters of liquid helium — only enough to fill about 26 1-gallon milk jugs. Image courtesy of National High Magnetic Field Laboratory.

In a recent draft of their five-year plan for 2010 to 2015, officials at Vancouver-based TRIUMF, Canada’s National Laboratory for Particle and Nuclear Physics and the world’s biggest cyclotron, cited the worldwide helium shortage as an impetus behind its proposal to erect a helium liquefaction plant and institute a recycling program.

TRIUMF, located on the campus of the University of British Columbia (UBC), is one of three subatomic research facilities in the world that specialize in producing extremely intense beams of particles. It uses about 30,000 liters of helium per year for experiments, while users at UBC need about 10,000 liters. The lab currently pays about CAD$340,000 a year for its helium.

After losing two major crude helium sources in the past year, TRIUMF’s liquid helium supplier warned that it can provide only 60 percent of the amount agreed upon under its contract and that price increases and order interruptions will continue. The lab also has taken issue with helium supplies that often are contaminated, which it said results in a significant loss of beam.

By buying its own liquefier, the lab could produce about 100 liters of high-quality liquid helium an hour, more than enough to satisfy its needs.

The National High Magnetic Field Laboratory at Florida State University in Tallahassee, also known as the Magnet Lab, uses about 100,000 cubic feet of helium every week and spends about $700,000 a year on helium. Officials hope that $1 million in upgrades to its helium recovery facilities, including the addition of a large-scale purifier, will lessen that expense.

“Over the past five years, our helium has gone up almost every year. That trend helped justify doing this upgrade, but it was something we were going to do regardless of the market, because we appreciate that it’s a nonrenewable natural resource,” said John Pucci, head of cryogenic operations and operations of the 45-tesla hybrid magnet at the Magnet Lab.

Because other elements freeze solid long before helium cools enough to liquefy, it is important that the gas they use be as pure as possible, Pucci said.

The lab can purify its helium, but “a big bottleneck of our recovery system is the ability to repurify it,” he added.

The Magnet Lab’s cryogenic operations serve as a community helium “well” for its researchers, but instead of buckets, it uses about 40 Thermos-like containers called dewars to transport the precious liquid to its 20 research labs.

“Once these dewars are spread out and used, once they get above atmospheric pressure, the helium changes back to a gas. At that point, each user is required to connect to the recovery bags,” Pucci said. The cryo team always assumes returned helium is contaminated in some way and must be repurified.

After its purification system is upgraded, the lab will increase its recycling ability significantly, from less than half of its helium to about 90 percent, Pucci said.

The superconducting 900-MHz NMR Magnet at the National High Magnet Field Laboratory enables scientists to look inside small living animals such as rodents, birds and insects, and helps researchers study tuberculosis, flu and neurodegenerative diseases. The cryostat contains 545 gallons of liquid helium, which keeps the magnet at 1.7 K (–456.61 °F). Image courtesy of National High Magnetic Field Laboratory.

The Magnet Lab uses the helium to make its magnets superconducting and to perform cryogenics experiments on helium, but its main use is to “slow down” molecular movement in experiments performed in the magnet bores. Researchers can record the event in higher resolution because, as it unfolds under the magnetic field, it is all in slow motion.

The Magnet Lab has three helium liquefiers. Two are part of a closed system that recycles the considerable amount of helium used to operate the superconducting part of its most powerful magnet, 45-tesla hybrid. Whether in use or not, the magnet always is kept supercold because it would take more than a month to move it from room temperature to operating temperature.

About a year ago, Pucci said, the lab invested about $20,000 in three helium recovery bags made of a reinforced flexible plastic material that each hold about 2700 cubic feet of gas. The huge bags look like mini blimps suspended from the ceiling, but when the gas inside is liquefied, it would fill only about 26 1-gallon milk jugs.

The bags are expected to be more sturdy than previous ones made of black rubber, which were chronically cracking, splitting and allowing gas to escape. “We’re hoping these last at least ten to twenty years,” he said.

In the future, Pucci said he envisions helium being treated somewhat like Freon, with industry having to reclaim or replace the gas.

“To me, the writing’s on the wall – if we don’t do this on our own, there will be a national program forcing us to conserve it,” he said.

<br“for>

<br="">

Helium for High Tech: Demand Ballooning

Helium, especially highly purified versions, increasingly has been in demand globally for its usefulness in high-tech applications, such as in microchip and flat panel display manufacturing or as a coolant for magnets in magnetic resonance imaging (MRI) machines, particle accelerators and fiber optics manufacturing. It also is used to pressurize fuel tanks on space shuttles and to provide a nitrogen-free, oxygen-rich atmosphere for deep-sea divers hoping to avoid “the bends,” and as a protective gas for welding applications and growing silicon and germanium crystals.

Because it is lighter than air and doesn’t burn, it is used as a safer alternative to hydrogen to lift scientific and recreational balloons, and commercial craft such as the Goodyear Blimp. It also enables festive balloons – from party decorations to Macy’s Thanksgiving Day Parade characters – to float, but that is a small percentage (less than 7 percent) of the overall helium market.

The helium molecule’s ultrasmall size, which allows it to slip through tiny holes and even thin membranes such as a rubber balloon skin – which explains the change to foil for helium party balloons – makes it ideal as a leak detector. </br=""></br“for>