RONALD MUELLER, VISION MARKETS, AND SEBASTIEN DIGNARD, IENSO INC.

Meet the author

Ronald Mueller is an expert in the global machine vision industry, with a Ph.D. in computer vision and machine learning. Based on his technical know-how, his experience as a corporate executive, and his first-hand experience in machine vision sales in Europe, North America, and China, he founded the consulting firm Vision

Markets in 2014. He, his team, and the

Vision Markets Network of experts are

dedicated to making businesses thrive in this globalized growth market of machine vision.

Meet the author

Sebastien Dignard, president of ienso Inc., has over 15 years of imaging experience. As the

former CEO and president of

FRAMOS, he established the company as one of Ottawa’s fastest-growing businesses. Founded in 2003, ienso accelerates the deployment of innovative imaging and wireless products in a wide range of verticals, including IoT, home automation, automotive aftermarket, drones, professional entertainment, home robotics, and remote surveillance and security.

In recent years, “embedded vision” has become a ubiquitous term in the industry. Open any vision trade magazine or visit a conference and you’re sure to come across promotions of embedded vision cameras, processing architectures, development kits, and accompanying services. Many traditional players in the industrial imaging industry now tout the capabilities and expertise of their embedded systems. This is with good reason: The influence and capabilities of imaging have moved beyond traditional application areas — which on the industrial side include factory automation,

logistics, traffic, and microscopy, and on the consumer end include mobile phones, tablets, webcams, and surveillance and action cameras.

More recently, other sectors — notably home automation and robotics — are turning to imaging, specifically embedded imaging. But herein lies the dilemma: Can we assume that all companies that have grown in traditional industrial or consumer imaging markets have the know-how to help these new prospects deploy imaging?

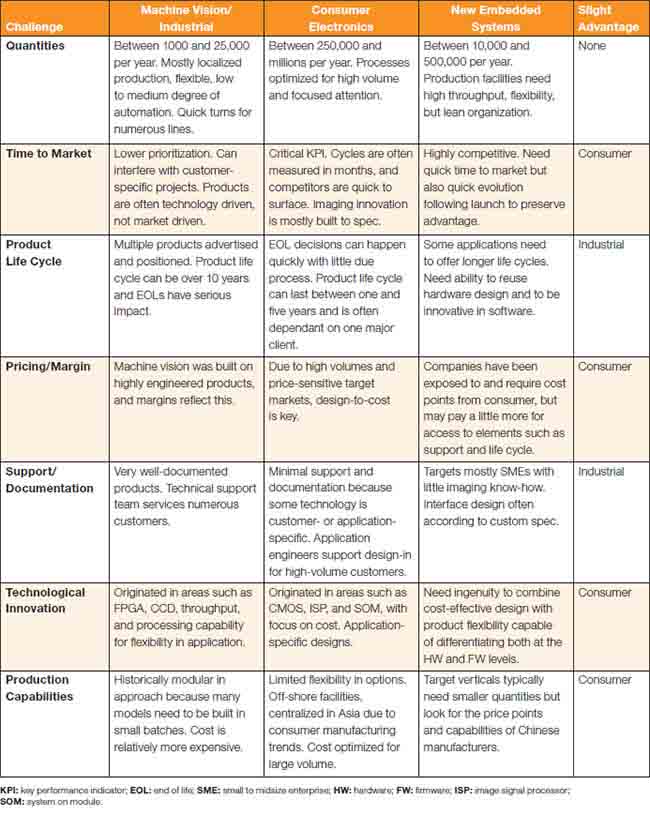

click table to enlarge

Although these new market opportunities seem to have surprised some industry veterans, the increased imaging needs of new verticals were predictable and find their origins in the innovation tied to peripheral technology that has been developed over several decades from a multitude of markets. Case in point:

It’s hard to imagine a booming home automation industry — one that gave rise to the visual doorbell — without effective and high-speed wireless technology.

Verticals such as home automation, robotics, autonomous vehicles (encompassing delivery robots, production logistics conveyor platforms, and the automotive aftermarket), precision farming, “prosumer” equipment (drones and robotics), and interactive toys are incorporating more and more imaging. The main reason may be because these markets can now exploit imaging’s full potential, thanks to the advent and evolution of integrated technology enablers that include wireless, AI, the cloud, edge computing, CMOS image sensor technology, and processing innovation (SOMs, ISPs, DSPs).

Making the pivot

These new verticals offer opportunities that both traditional machine vision/industrial and consumer imaging players would like to capture because of overall growth potential and profit expectations. As they sell into these markets, both of these groups of players believe they can amortize the technology and capabilities they have already developed —

but they face challenges rooted in the founding principles that have made them successful in their core markets (see table).

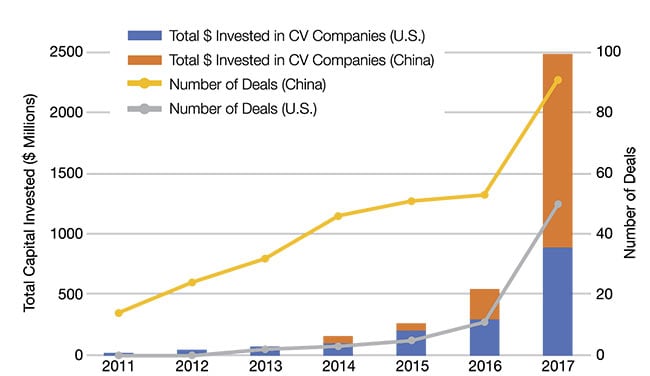

China versus U.S. investment in vision companies between 2011 and 2017. CV: computer vision.

On the one hand, many machine vision companies had to engineer their products in a way that

enabled integration into many different verticals — and this required FPGA (field-programmable gate array)-based designs. On the other hand, the consumer imaging companies were able to design one image sensor with a DSP/ISP, due to the high volume and focus on their applications. In these cases, one player has roots in expensive FPGAs

while the other has cost-effective but inflexible

designs — making them both unnatural fits for

some of embedded imaging’s most promising markets.

Embedded imaging in comparison to the traditional industrial and consumer spaces. Courtesy of ienso Inc..

No one can predict who will be able to pivot and dominate the embedded imaging market successfully, but the eventual market leaders must understand the needs and wants of the new prospects and so evolve in a changing market space as they address these growth-ready market segments.

The views expressed in ‘Field of View’ are solely those of the author and do not necessarily represent those of Photonics Media.