After losing momentum during the global pandemic, China's market for industrial lasers is showing signs of recovery and even acceleration.

BO GU, BOS PHOTONICS

The Chinese economy was

on a roller coaster in 2022 but evened out at the end to grow its gross domestic product by 3%, which is very slow growth by China’s standard. The bright side, however, was that the country’s high-tech manufacturing industries grew at a much faster pace of 7.4% compared to the previous year. This latter trend strongly supports the stable development of China’s laser industry and has led to the rapid transformation and upgrade of its national economy.

The impact of COVID-19 on the Chinese laser industry was minimal until 2022. Many Chinese cities with significant laser business, such as Shanghai, Suzhou, and Shenzhen, were affected by the last few waves of the pandemic.

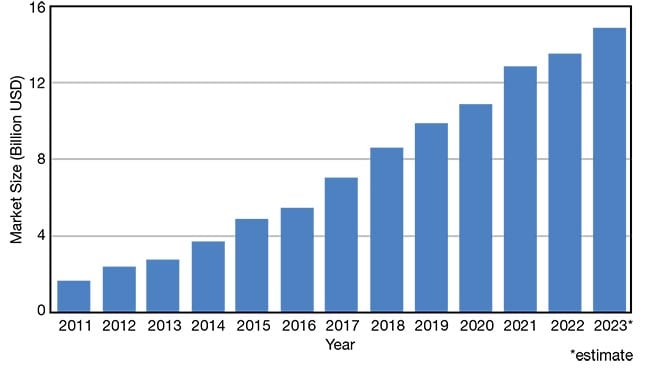

Consequentially, the growth of the

Chinese industrial laser market slowed to 5%, falling short of the forecasted 10% to

reach a total market size of $13.5 billion by the end of last year (Figure 1). As COVID-19 fades, the Chinese overall economy is expected to recover and grow

~5% this year. Its laser industry, in particular, will recover vitality to see an annual growth rate of 10% by the end of 2023.

Figure 1. China’s laser market between 2011 and 2023. China’s industrial laser market reached $13.5 billion in 2022 with an annual growth rate of 5%. Courtesy of BOS Photonics.

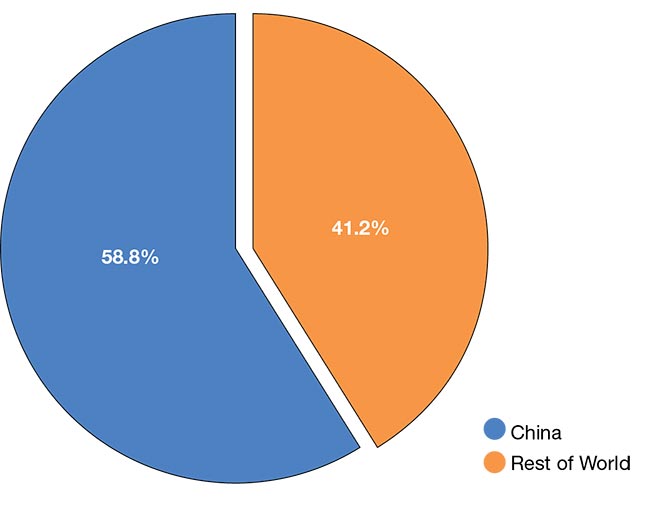

In addition to COVID-19, the Chinese economy was facing triple pressures in 2022: demand contraction, supply chain disruption, and weakening economic activities. China’s share in the global industrial laser market decreased slightly to 58.8% in 2022. It had been 60.1% in 2021 (Figure 2).

Figure 2. Global market share for industrial lasers. China’s share of the global industrial laser market decreased slightly in 2022 to 58.8%. It had been 60.1% in 2021. Courtesy of BOS Photonics.

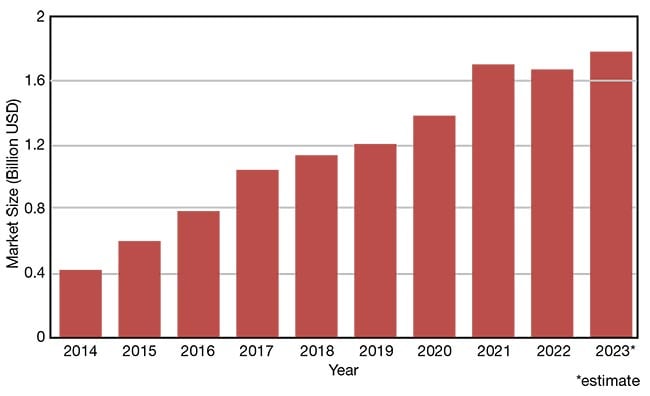

Specifically, the Chinese fiber laser market remained largely stable in 2022, registering a minor increase in sales volumes over the previous year, but had a decline in revenues and profit margins. The sales revenue of the Chinese fiber laser market decreased to $1.7 billion last year, having a negative growth of 1.8% for the first time. It is expected that the entire fiber laser market will rebound this year, however, and show a positive growth of 6.4% or $1.79 billion in 2023 (Figure 3).

Figure 3. China’s fiber laser market between 2014 and 2023. The size of China’s fiber laser market remained stable in 2022, with a minor increase in sales volumes over the previous year, but a decline in revenues and profit margins. Courtesy of BOS Photonics.

China’s market for laser cleaning also showed fast growth last year due to the low costs of fiber lasers and direct-diode lasers.

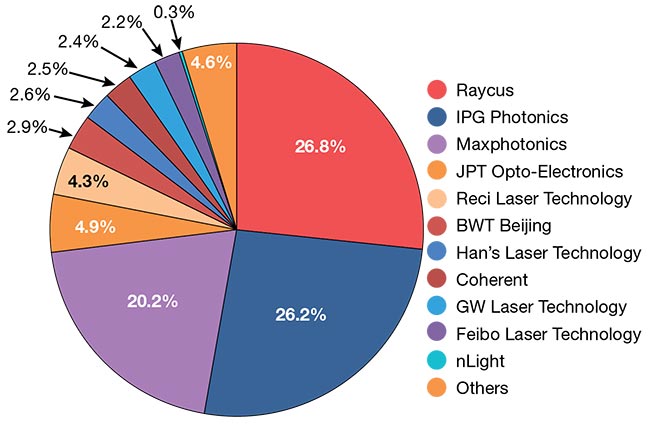

BOS Photonics recently reported fiber laser price erosion in China. The price war for fiber lasers reinforced this erosion in 2022, and even spread to fiber laser

components and fiber laser-based systems. The price erosion has also shifted from low-end to high-end products, with price reductions of up to 40% last year. This multiyear price war has brought many companies to the brink of bankruptcy.

The overall outlook for the Chinese fiber laser market in 2022 includes an expected increase in volume, a decrease in prices, and low or no profits. It is likely that changes in market share will continue. With 26.8% market share, Raycus Laser recently surpassed IPG Photonics

to become the largest fiber laser supplier

of customers in China (Figure 4). Meanwhile, IPG’s sales in the Chinese market have decreased by 12.5%, while nLIGHT’s revenue decreased by 62% in 2022.

Figure 4. Market share: China’s fiber laser suppliers. China’s market share showed a notable shift recently between domestic and international suppliers, with China-based Raycus Laser overtaking U.S.-based IPG to become the new market leader. Courtesy of BOS Photonics.

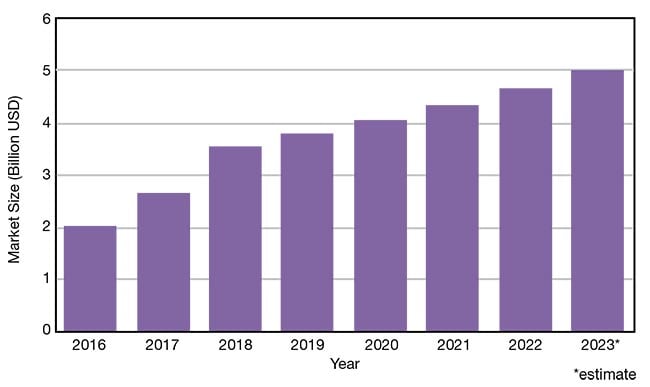

The Chinese market for laser cutting machines is influenced by the fiber laser market. Although the unit number for fiber laser cutting machines has grown rapidly, the unit price of the equipment

has decreased. As profit margins decreased, many Chinese enterprises

targeted overseas markets. The total market for cutting machines reached

$4.6 billion in 2022 and is expected to exceed $5 billion in 2023, a year-on-year increase of 7.6% (Figure 5).

Figure 5. China’s market for laser cutting machines between 2016 and 2023. China’s market for laser cutting machines has seen rapid growth in the unit number for these systems, but a drop in their unit price. The country’s overall market for cutting machines reached $4.6 billion in 2022 and is expected to exceed $5 billion in 2023, a year-on-year increase of 7.6%. Courtesy of BOS Photonics.

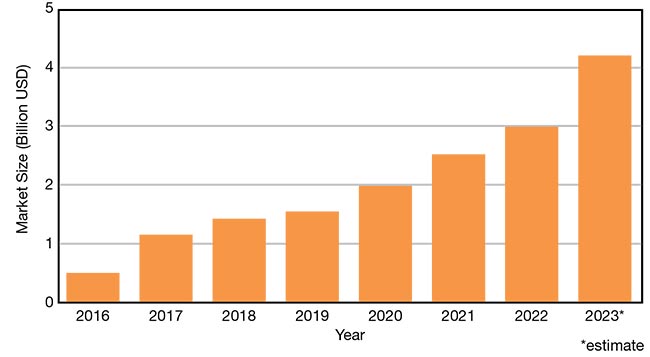

Laser welding

In recent years, laser welding equipment has ushered in new market opportunities. This technology has seen gradual

adoption, for example, in precision microprocessing applications for power batteries, automobiles, and consumer electronics, as well as for aviation and rocket engines, spacecraft, automotive engines, and other sectors that require lasers to weld highly complex component structures. In 2022, China’s market for laser welding systems was ~$3 billion, a year-over-year increase of 25%. With the increasing demands from domestic power battery manufacturers, the demand for laser welding equipment is expected to increase significantly. Therefore, the overall market for laser welding equipment is expected to exceed $4.2 billion in 2023, an increase of 44% over last year (Figure 6).

Figure 6. China’s market for laser welding systems between 2016 and 2023. Driven by precision microprocessing applications, laser welding equipment has seen gradual adoption over the years in China. Last year, the country’s market for laser welding systems neared $3 billion, an increase of 25% over 2021. Courtesy of BOS Photonics.

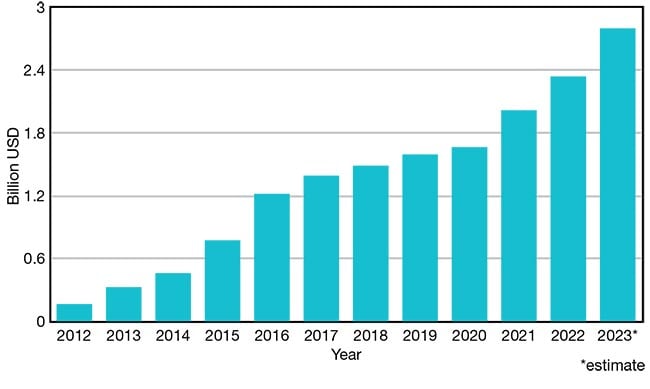

China’s laser additive manufacturing market reached $2.3 billion in 2022, an annual growth of 16% prompted, in part, by three trends unfolding in that country: the industrialization of its additive manufacturing processes, emergence of new business models, and broader adoption of laser systems for the 3D printing of metals. All three trends have played an important role in growing China’s market for laser-base additive manufacturing, which is expected to reach $2.8 billion in 2023 (Figure 7).

Figure 7. China’s market for laser additive manufacturing equipment between 2012 and 2023. China’s market for laser additive manufacturing equipment reached $2.3 billion in 2022 and is on track to reach $2.8 billion in 2023. Courtesy of BOS Photonics.

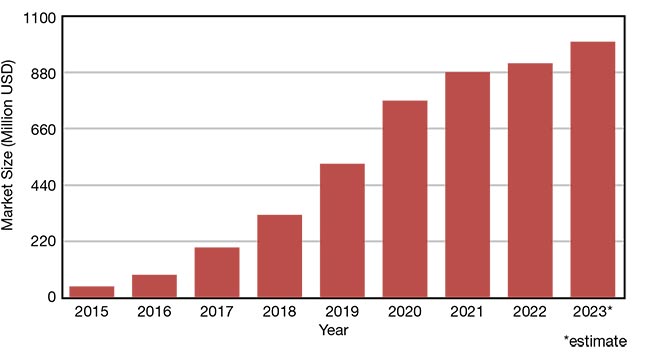

Driven by demand from the semiconductor and display manufacturing sectors as well as glass processing applications, China’s market for ultrafast lasers is growing rapidly. Currently, 80% of ultrafast lasers sold in these Chinese sectors are picosecond sources, though market share for femtosecond lasers grew from 10% to 20% last year. Domestic-made ultrafast lasers accounted for 30% of the overall market value for ultrafast systems, which reached $913 million in 2022; this market is expected to reach more than

$1 billion by 2023 (Figure 8).

Figure 8. China’s market for ultrafast lasers between 2015 and 2023. China’s market for ultrafast lasers is growing rapidly. Domestic-made ultrafast lasers accounted for 30% of the overall market value for ultrafast systems, which reached $913 million in 2022. That market is expected to reach more than $1 billion by 2023. Courtesy of BOS Photonics.

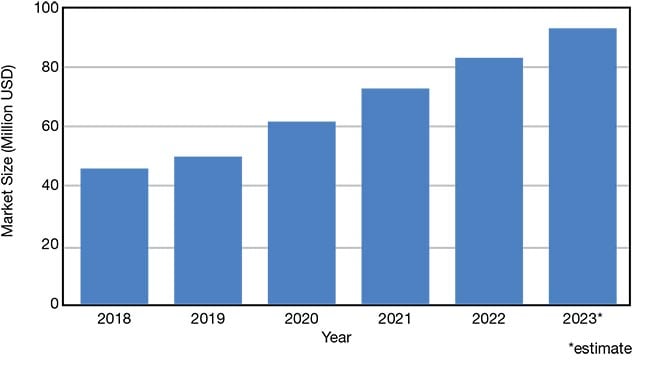

China’s market for laser cleaning also showed fast growth last year due to the low costs of fiber lasers and direct-diode lasers. In total, the market reached $83 million in 2022 and is expected to be around $93 million in 2023 (Figure 9).

Figure 9. China’s market for laser cleaning systems. China’s market for laser systems targeting cleaning applications showed fast growth last year thanks to the low costs of fiber lasers and direct-diode lasers. In total, the market reached $83 million in 2022 and is expected to be around $93 million in 2023. Courtesy of BOS Photonics.

Import and export

China’s import and export of laser

components decreased in terms of volume and value last year. The number of units imported and exported in 2022 was pegged at 103 million and 18.9 million,

respectively. The dollar amounts, meanwhile, for imported and exported laser components reached $2.43 billion and $664 million, respectively.

These collective decreases were due, in part, to domestic supply exceeding China’s market demands, an increase in tariffs, trade barriers imposed on Chinese laser products, and the impact of COVID-19.

Overall, 2022 was not a typical year for the Chinese laser industry. Markets for laser welding, cladding, and cleaning were the highlights of last year and will continue to be this year.

Also, expect to see some differentiated development in fiber lasers this year to avoid further price wars. Expanding in overseas markets will also be a target for Chinese manufacturers of laser cutting machines in the near future. Looking ahead, the Chinese industrial laser market is expected to resume its familiar pace of double-digit growth. Specifically, BOS Photonics forecasts growth in 2023 to reach 10%.

Meet the author

Bo Gu, Ph.D., is founder, president, and CTO of BOS Photonics, a Boston-based consultancy providing services to the laser and photonics industry; email: [email protected].