Export Controls Re-Sharpen the Optics Industry’s Focus on Alternate Materials

China’s recently issued export controls on two rare-earth metals, gallium (Ga) and germanium (Ge), have intensified the scrutiny of the global supply chain for these materials. The Chinese directives mandate that its domestic exporters must now obtain a license to distribute the metals across international borders.

China’s recently issued export controls on two rare-earth metals, gallium (Ga) and germanium (Ge), have intensified the scrutiny of the global supply chain for these materials. The Chinese directives mandate that its domestic exporters must now obtain a license to distribute the metals across international borders.

Both materials are needed to make alloys and compounds, which are vital to the production of semiconductor chips, optics, laser diodes, and other components.

State-ordered restrictive action is hardly unfamiliar in the highly complex and ongoing global struggle for chip supremacy between the U.S. and China.

China unveiled export controls this summer on its ample supply of germanium (Ge), prompting a discussion in the optics industry about the potential that chalcogenide glass materials offer as a substitute for Ge optics. Manufacturers have taken action by announcing plans to scale up production of chalcogenide materials and seek to qualify the glass for broader use in defense and surveillance applications. Courtesy of LightPath Technologies.

Still, there are concerns that the recent brinkmanship over export controls for semiconductor equipment could escalate into a broader commercial dispute. And, in the wake of the two recently passed CHIPS Acts in the U.S. and European Union (EU), China’s market share on critical raw materials is considerable. The figures from sources including the Institute of Rare Earth Elements and Strategic Metals, the United States Geological Survey (USGS), and the Critical Raw Materials Alliance indicate that China yields between 80% and 98% of the global supply of Ga in its raw form. Estimations indicate that it holds 60% of the world’s supply of Ge. According to data from the USGS, integrated circuit chips accounted for 74% of Ga consumption in the U.S. last year; optoelectronic devices accounted for 25%; and >75% of the Ga consumed in the U.S. was in the form of gallium arsenide, gallium nitride, or gallium phosphide wafers that are used to make microelectronics.

Additional numbers explain the unease from a Western perspective. Between 2018 and 2021, per the USGS, more than half of all Ga metal imported by the U.S. came from China. EU data indicates that China is the source of >70% of its raw Ga metal supply.

As such, it was an immediate concern that a repercussion in semiconductor manufacturing would ensue after China’s announcement on July 3, which gave chip makers one month to perform risk assessments before the restrictions took effect in August.

Amid their planning, similar activity ramped up in the optics sector. Manufacturers detailed actions that they would take in the face of potential market disruption.

The prioritization of alternate materials, such as chalcogenide glass as a substitute for Ge optics, was a top order of business.

Following the announcement of China’s export controls on gallium (Ga) and germanium (Ge), LightPath Technologies said in July that the U.S. Department of Defense (DoD) will provide funding to qualify new chalcogenide glasses as potential substitutes for Ge. The company’s BD6 IR chalcogenide glass offering is already deployed in defense systems. Courtesy of LightPath Technologies.

Downstream from the obvious question about whether critical materials will fall into short supply, China’s measures also prompted questions about how these chalcogenide materials compare as alternatives to Ge, and to what extent they may be needed as a substitution for the legacy material.

Industry action

As analysts pointed out this summer, the potential effects that China’s restrictions could have on supply chains are unlikely to reverberate in full effect in the immediate term. However, the prospect of further tit-for-tat commercial conflicts persisting during the coming months raises the pertinence of a discussion regarding chalcogenides in the present.

The optics industry was quick to join the conversation after news broke that China would institute licensing requirements for Ga and Ge. The export controls expedited the type of planning that stems from the likelihood of sustained uncertainty, said John Anagnost, an engineering fellow at NewBridge Partners who previously served as a senior principal engineering fellow at Raytheon.

“I would say that most people think that this ‘tit-for-tat,’ at least, is probably going to continue for a while,” said Anagnost. “It’s an escalating situation.”

The prevalence of Ge optics in defense and intelligence applications, such as night vision, longwave IR imaging, and space systems means that consumers in those markets could begin to consider comparisons between Ge and its chalcogenide alternatives in lieu of China’s measures, Anagnost said.

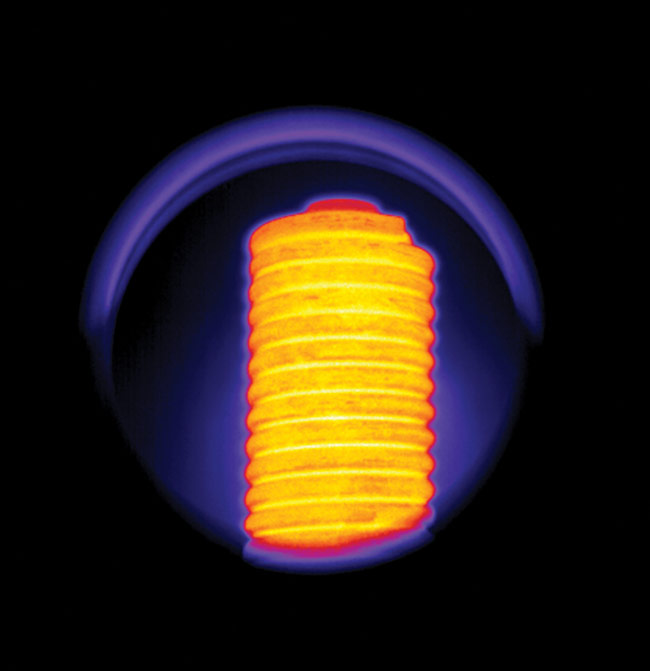

Thermal image of a heating coil inside a furnace captured through a chalcogenide glass window. Amid its announcements in July to offer its signature chalcogenide materials in raw form, LightPath Technologies acquired Visimid Technologies, an engineering and design firm that specializes in thermal imaging, night vision, and Internet of Things applications. Courtesy of LightPath Technologies.

Suppliers for the commercial defense market are acting accordingly, too. Rochester Precision Optics (RPO), for example, said in July that it will upscale the production manufacturing of its CLASSIC Series of chalcogenide materials. The company highlighted its chalcogenide glass materials as potential alternatives to the crystalline Ge and Ga substrates that are used in IR imaging optics. RPO said its six-glass series includes three offerings with reduced Ge content. It also features a classic arsenic40 selenium60 (As40Se60) chalcogenide composition. This glass is one of the most widely used and recognizable chalcogenides for longwave IR imaging and other applications that have traditionally favored Ge optics.

Other companies also market a similar

composition of chalcogenide glass,

including SCHOTT’s IRG 26 and Light-

Path’s BD6 materials. According to Sam Rubin, CEO of LightPath Technologies,

BD6 chalcogenide’s potential as an alternative to Ge in space and military applications has prompted designers to increase demand for the material.

With the heightened demand for

materials fueled further by China’s export controls, LightPath announced that it would offer its BD6 IR chalcogenide

glass in raw material form. The company

previously offered BD6 only in finished lenses or integrated into custom solutions.

The full suite of BD-class glass has its

roots in optical materials that were developed at the U.S. Naval Research Laboratory (NRL). Last summer, industry stakeholders launched their appeal for the

Defense Logistics Agency (DLA) to qualify the materials developed by the NRL and licensed by LightPath for use in defense as a Ge alternative, Rubin said.

Upon the announcement of China’s

export controls, LightPath said in July that the U.S. Department of Defense (DoD) — via the DLA — will provide funding to qualify new BD chalcogenide glass as substitutes to Ge. The company’s BD6 offerings are already qualified for defense applications and deployed in

active systems, Rubin said.

Performance comparisons

China’s restrictions on Ga and Ge are

the most potent catalyst for the current surge of interest in the comparative

performance capabilities of Ge and chalcogenides, according to David Musgraves, an optical materials expert, industry consultant, and former chief scientist and director of R&D at RPO.

The distinct compositions that define each class of materials yield their comparative merits and drawbacks. Crystalline Ge is a tougher material than chalcogenide glass, and the natural choice for

lenses, windows, aspheres, and other optics that need to optimize impact resistance. But Musgraves said chalcogenides can replace Ge in most other applications without compromising performance. “The chalcogenide lens will also weigh less and can be fabricated at lower cost compared to germanium,” he said.

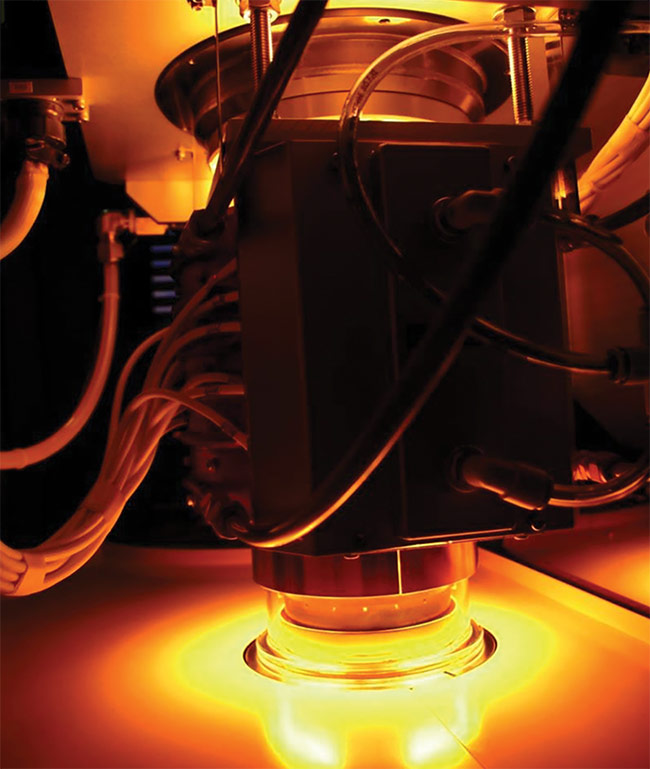

Chalcogenide glass offers a lower refractive index than comparable optics fabricated with germanium (Ge), which becomes opaque at temperatures above 65 °C. Certain chalcogenide glasses are favored for particular extreme environment applications because the material(s) avoid(s) thermal darkening. Courtesy of FISBA LLC.

Wallace Latimer, president of FISBA LLC, agreed the materials share highly similar characteristics. One difference, he added, is Ge’s susceptibility to thermal darkening; the material experiences a high change of refractive index with temperature fluctuations and becomes opaque at high temperatures. Another difference — Ge’s hardness compared to chalcogenides — has become less of an advantage due to advancements in hard carbon coating technology.

“In terms of a ‘one-for-one’ swap as far as assembly is concerned, if you correct and optimize for the [refractive] index differences between the two materials, then realistically there is a minimal

difference,” Latimer said.

According to Anagnost, industry worked with earlier chalcogenide glasses for decades and found the materials to be remarkably similar. “Working with chalcogenide glasses was a more cost-effective practice for us than machining a large hunk of Ge to the size that we wanted,” he said.

Anagnost added that Ge’s popularity, especially as a substrate, is largely due to its high refractive index. This, paired with its transmission properties extending out to the longwave IR, solidified it as the designers’ material of choice for many IR lens fabrications. For his team, however, the temperature-induced change of index in Ge optics was a detrimental feature, especially in aerospace applications.

“Not all systems designers agree, but we regard the lower refraction indices with chalcogenides as relatively minor impacts for our applications,” Anagnost said, referencing sensing in extreme

environments, thermal imaging, and chemical sensing.

Chalcogenides in context

Though the NewBridge team can chart performance and usability increases in contemporary chalcogenides versus legacy chalcogenides, Anagnost still

regards Ge as the de facto standard against which chalcogenides gauge their progress. The glass remains among the few materials that present an alternative to Ge. For this reason alone, he said, it warrants consideration for defense and security applications.

According to Musgraves, designers and manufacturers such as LightPath and RPO are backboned by precision glass molding capabilities.

“Compared to Ge, which requires single point diamond turning, those companies can churn out chalcogenide lenses quickly,” he said.

Economic advantages stem from such serialized manufacturing processes, and chalcogenide producers are clearly reactive to factors that influence the marketplace for Ge. These chalcogenide producers are also helped by the increase of products, such as night-vision goggles, that are emerging in the consumer market, Musgraves said.

However, those positive tailwinds fail to address what has long been the major bottleneck to the increased adoption of chalcogenides.

“The hangup is getting onto DoD lens prints,” Musgraves said.

LightPath, for example, has found success moving toward Military Specification qualification with direct support

from the DoD.

The sheer number of distinct chalcogenide materials that the company offers, and now aims to qualify, has helped to bridge the gap between Ge and chalcogenides, Rubin said. Still, there is no way for defense contractors to entirely avoid system redesign, especially for legacy systems, he said.

According to Latimer, the challenge in qualifying chalcogenide materials to meet the existing requirements of the DoD and even some Tier 1 contractors, for example, is an expensive and long-term undertaking using existing platforms.

“It becomes a pretty big lift,” Latimer said. “Different refractive indices mean you need to redesign whole elements to ensure you get the same optical performance that Ge delivers.”

Long game

Against the backdrop of geopolitical trade tensions, China’s new restrictions on the flow of Ge could help overcome some of the reluctance of system designers to move away from legacy materials.

“We hope that more of the optics industry will transition from Ge to chalcogenides, and we view the restrictions as an accelerator to that,” Rubin said. “But I think [the restrictions] will be more about changing the timing of when the dynamics of the industry change long-term than about changing the dynamics now.”

Before a wholesale materials swap, Rubin said that he expects the U.S. and other players to invest in Ge sourcing if the

tit-for-tat with China continues. New supply streams of Ge — paired with a sustained increase in the adoption of

chalcogenides — could help solve a

supply problem that many believe is years away from hitting its peak.

Materials companies outside of the optics sector moved in this direction this summer. Los Angeles-based distributor American Elements said in July that it planned to expand the production of Ga and Ge from its Salt Lake City, Utah, plant.

A month later, Canadian company Ares Strategic Mining said that it located both materials in a fluorspar project also in Utah.

Announcements like these have increased since July 3. But mining takes time to ramp up. It is also expensive.

“You only choose to set up mines if you are confident that they will be economical,” said Fred Carrington, director of sales and purchasing at metals purchasing and repurposing firm Exotech.

“It’s highly unlikely major rare-earth mining will take place in the West while there is still Chinese material available.”

How long that will remain the case is a mystery. So far, there has been minimal disruption to the Ge market in the aftermath of the Chinese export controls, Latimer and Musgraves said. Historically, a lack of change in the market equates to a lack of change in the industry.

Published: September 2023