Should Europeans adopt more of an American “rock star” attitude toward technology transfer? Perhaps we have a lot to learn from our US cousins when it comes to backing that promising business venture.

Europe enjoys an excellent standing in pioneering research – but, alas, this reputation for excellence does not always carry through from research to commercialization. The antagonists to technology transfer range from funding issues and intellectual patent nightmares to a cultural aversion to risk-taking.

In Europe, the importance of photonics has been widely recognized. The European Commission has highlighted photonics as one of six key enabling technologies (KETs) essential for Europe’s economic growth. And it’s no surprise, as more than 20 percent of the European economy and 10 percent of the workforce depend on photonics, which affects about 30 million jobs, according to a recent survey carried out by the European Union (EU) photonics unit.

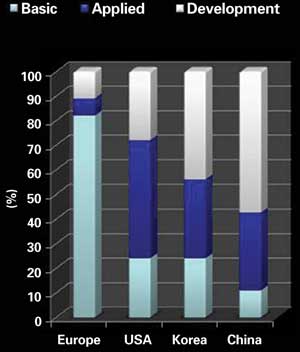

Europe lags behind competitor nations when it comes to transforming basic research into commercial development. Courtesy of KET Report: Strategic focus on applied research and development.

In the same way that the 20th century was the century of the electron, many experts believe that the 21st century will be the century of the photon. But with such wide-ranging applications, technologies such as photonics can suffer from fragmented development, which can hinder growth and progress.

Ensuring the financial health of Europe’s KETs is Horizon 2020, the EU’s Framework Programme for Research and Innnovation, which, with an €80 billion budget, aims to drive and create new growth and jobs in Europe. Horizon 2020 will run from 2014 to 2020 and comes as welcome news in Europe, where funding can be a real impediment to product development.

The lack of available fast funding is one of the biggest hindrances to technology transfer in Europe, according to Dr. Eugene Arthurs, CEO of SPIE.

Above, metal cutting with Jenoptik’s JenLas fiber cw 1000. Courtesy of Jenoptik AG.

“Access to capital is one of the advantages companies in Silicon Valley or China may have compared to European competitors,” he said. “Economic constraints in both private and public funding have hampered some efforts, but there are some shining examples of successful tech transfer.”

The Fraunhofer facilities are one such example, bringing research and development under the same roof. Student and faculty pursue both pure and applied research; engineers, technologists and marketing teams provide input into application ideas along with development. Fraunhofer Institutes now number more than 80 research units, including 20 outside of Germany.

“Often, technology transfer occurs through the establishment of a new company, such as the recently formed Trumpf partnership with Max Planck in an enterprise to develop and manufacture ultrashort-pulse lasers for the scientific market based on Trumpf’s disk laser technology,” he said.

Despite an excellent research base, Europe lags in turning inventions into innovations (see the graph). Funding needed for bringing the idea or preliminary lab results into a well-engineered, robust product (e.g., ultrafast laser) is usually missing, said Dr. Bojan Resan, product manager of scientific lasers at ultrafast laser specialist Time-Bandwidth Products AG in Zurich.

The Ybix (left), Duetto (middle) and Ergo lasers (right) from Time-Bandwidth Products. Launched at BiOS and Photonics West, Ybix is designed for biomedical multiphoton imaging and nanosurgery. Duetto is well established for micromachining, and Ergo is the enabling technology laser for high-data-rate transmission systems in telecom. Images courtesy of Time-Bandwidth Products Inc.

Most of the EU’s research funding is oriented toward applied research or demonstrating the first prototype, but Resan points out that most resources are actually spent subsequently on engineering.

“In [the] case of lasers, this [funding] is [on] more compact mechanical packaging, electronics automatization, user-friendly software, etc.,” he said. “This ‘dead valley’ for product development is well addressed by the EU’s Nexpresso program. However, this program has [a] very limited budget, both total and per project.”

Metal processing at Jenoptik. Courtesy of Jenoptik AG.

Lack of funding is perhaps most keenly felt by smaller companies, which, without strong backing from external investments, have fewer resources and need more time to accumulate the sufficient profit to be invested in the technology transfer of a new product.

The slow transition from photonic inventions to industrial deployment has been dubbed the “valley of death” in the Photonics KET report. In response, the Photonics21-proposed public-private partnership, which appears to have high-level support within the European Commission, is one way in which technology transfer in photonics may be aided in the future.

Regulations: Help and hindrance

Regulations have a big influence on market demand and can stimulate demand for a new technology. For example, the EU’s emissions regulation has a direct effect on demand for new high-performance optical measurement equipment for quality assurance in automotive production.

Laser manufacturing in Jena. Courtesy of Jenoptik AG.

Some regulations, although necessary, obstruct market access or market demand, said Jenoptik AG’s Felix Brandes, who is in charge of strategic research collaborations. Jenoptik is an optoelectronics group based in Jena, Germany.

“This often has to do with environmental or health and safety regulations. Think of the use of new lasers in surgery, or hazardous materials in production,” he said. “However, regulation in these areas is necessary and beneficial to protect our health and safety as citizens. Regulators are hence caught in a constant trade-off between protecting people and the danger of overregulation hindering new technologies.”

For Resan at Time-Bandwidth Products, the increasing number of costly certificates required for components and systems (radiation, toxicity, documenting and so on) prolongs the technology transfer process and means that more funding investment is needed. He said they place a particular burden on small companies, which have a harder time investing large amounts of funding and time for certificates of novel, not-yet-proven products.

Brandes calls for an alignment in regulations across countries, especially in the EU. For companies with high export rates, such as those in the photonics business, “it is almost impossible to take into account the different regulations across countries when developing new technologies. This is particularly an issue for small companies that cannot fall back on international business structures.”

Intellectual patent rights have blighted technology transfer in Europe for years. Absurdly enough, many valuable ideas have been lost in IP wrangles, and although regulations that smooth and speed the IP flow can be found, they do not go far enough for most.

“One of the best ways for IP to move is to have people move,” said SPIE’s Arthurs. “The recent patent reform approved by the European Parliament is an important move and should simplify the process and reduce the cost of acquiring EU-wide protection for inventions. Decades in the making, the new unitary patent protection system eliminates the red tape of having to get patents translated into around 20 languages or more and is expected to benefit the EU economy overall and innovative SMEs [small and medium enterprises] in particular.”

Cultural attitude

Beyond regulations, there are cultural blockages. There sometimes exists a lack of awareness between industry and academia, which can be difficult to bridge.

“Too many in academia hold industry in low regard, and too many academic institutes make it near impossible to move from industry into a world where scientific publications totally outweigh competence in the commercial sphere,” Arthurs said. “Industry, ‘the real world,’ is often loath to tap into the talent in academia with its different values set and timescales.”

It seems times have changed, and university researchers and industry inventors both must become more aware of what the other contributes to realizing the full value of technology transfer.

“It should be a two-way street, not simply a handoff by the researcher of his or her ‘eureka moment’ to a developer who takes the idea to market,” Arthurs said. “This is the old linear model now seen as too simplistic. Fruitful technology transfer is driven by continuous feedback from manufacturers and potential customers to the researchers.”

But as with any good idea brought to market, without bold investment, it will remain just a good idea. Financiers in Europe and, especially, the UK appear very much more inclined to invest in “safer” bets – or at least have been in the past. New and disruptive technologies are often seen as risky investments.

“Culture is difficult to change, but celebrating risk-taking and wealth creation would be a start,” Arthurs said. “In Silicon Valley, the business starters have more prestige than sports champions or rock stars, both because they change the world and because they enjoy the potential to realize extraordinary personal income via ownership in enterprises.”

Organizations aiding technology transfer in Europe

• SPIE, the international society for optics and photonics:

- The group organizes several European meetings in which exhibits play a large part.

- Photonics West, with its very international exhibition, is another fertile ground for connecting

researchers and developers.

- SPIE Startup Challenge has effectively brought VC and commercial company attention to the ideas

of researchers with marketable ideas, with several new products already in the market as a result.

• The Fraunhofer Institutes include more than 80 research units, with 20 outside of Germany.

• Knowledge Transfer Networks, and Technology and Innovation Centers are currently being established

in the UK under the Technology Strategy Board.

Winners of the ETP Photonics21 Student Innovation award 2012. Courtesy of SPIE.

• Enterprise Europe Network’s database is designed to connect research projects with commercial

applications.

• Tekes (the Finnish Funding Agency for Technology and Innovation).

• The Federal Institutes in Lausanne and Zurich.

• Approximately 40 regional photonics clusters in Europe are aided by the EU’s ASPICE (Action to Support Photonic Innovation Clusters in Europe).

• Academic institutions – university offices seek and develop R&D partnerships with industry.

“Many companies are also investing in tech transfer, often without direct benefit to their own enterprises,” SPIE’s Arthurs said. “The SPIE Startup Challenge and Prism Awards for Photonics Innovation engage aspiring entrepreneurs, startups, and established companies from around the world with opportunities for ranking – one of the most difficult parts of tech transfer.”

Other examples of industry support include Jenoptik, which supports the SPIE Startup Challenge with significant cash prizes as well as judging expertise; the Berthold Leibinger Prizes awarded at Trumpf; and the Carl Zeiss Research Awards, which also support technology transfer projects.

The Photonics21 Student Innovation Award has been established by the European Technology Platform Photonics21 and honors excellent industrial-related photonics research.