COVID-19 has changed the way venture capital firms approach university-based photonics startups in the U.S., but government-funded programs remain stable.

JAMES SCHLETT, CONTRIBUTING WRITER

Lately, Les Craig, a partner with Next Frontier Capital, has been feeling as though his business is on another world. His venture capital fund is based in Bozeman, Mont., which is renowned for having one of the highest densities of optical companies in the country due to the presence of the Spectrum Lab and Optical Technology Center (OpTeC) at Montana State University (MSU).

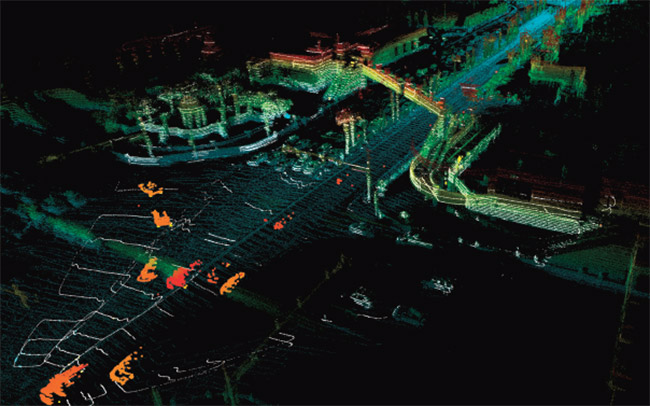

A lidar map from self-driving technology startup Aurora, which acquired Blackmore Sensors and Analytics in 2019. After being spun out from Bridger Photonics, Blackmore received Department of Defense seed funding under the SBIR and STTR programs. Venture capital funding, such as investments from Next Frontier Capital and Millennium Technology Value Partners in 2016, helped Blackmore to enter the autonomous vehicle market. Courtesy of Aurora.

Bozeman’s proliferation of tech start-ups was what had helped spur the formation of Next Frontier in 2015. The firm has already invested in two photonics companies, including Blackmore Sensors and Analytics, which has roots in the Spectrum Lab. However, that other-worldly feeling has Craig thinking the pace of venture capital (VC) investment activity in university-related photonics startups will be substantially slowing for the next six months because of fallout from the coronavirus pandemic. It all boils down to valuation.

“We’re on Mars but we’re weighing everything based on Earth’s gravity. … We’re on a different planet. There’s different gravity in the valuation of deals,” Craig said.

With COVID-19 unsettling the historical formulas on which investments had been based, Craig believes VC firms will be wary about investing in photonics startups because it is not clear how deals will be priced in the future. However, the uncertainty caused by COVID-19’s economic disruption has not derailed all investment activity. For example, UAVenture Capital in Tucson revealed this past April that it had invested in CMLaser Technologies Inc., a startup out of the University of Arizona. CMLaser is attempting to commercialize laser-based countermeasures for military and nonmilitary aircraft.

UAVenture is one of the more aggressive VC firms in regard to investing in university-related photonics startups. Several of the 16 startups in its investment portfolio are photonics related. Craig doubts there are enough university-related photonics startups nationwide to support a VC firm that invests exclusively in them. Next Frontier looks at 300 to 500 startups annually, but only only three to five actually result in deals.

For the photonics industry, VC funding is a novelty, with Next Frontier and UAVenture being only a few years old. Traditionally, state and federal seed funding programs have supported the lion’s share of commercialization efforts. The federal government is by far the biggest provider of seed funding for photonics startups, primarily through the Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs.

“Historically, most Montana photonics startups have gotten started via SBIR/STTR, before generating enough revenue to sustain themselves,” said Daniel Juliano, the director of MSU’s technology transfer office. “A few are still stuck in the SBIR/STTR mode. VC is a relatively new option for our companies, and wasn’t really available before Next Frontier Capital started.”

Between 2014 and 2018, more than 1400 firms were awarded $1.97 billion in SBIR and STTR funds for projects related to photonics**, according to a Photonics Media analysis of awards listed in the SBIR.gov database. Eighty-seven percent of that funding, or $1.7 billion, went to photonics-related projects under the SBIR program.

A field test of an insect lidar. Under a $225,000 Phase 1 STTR, Integrative Economics of Portland, Ore., partnered with MSU’s Spectrum Lab to develop a lidar system that detects and measures insect populations flying in orchards, vineyards, and other agricultural settings. Courtesy of Joe Shaw/Montana State University.

The SBIR program dates back to the recession of the early 1980s, when the Reagan administration created it to allow federal agencies to bolster the R&D capabilities of certain small businesses via funding, while also creating private sector jobs. Another payoff that the federal government receives from this program is a stronger return on investment. According to the Small Business Technology Council, when compared to universities, the SBIR program is 35× more effective at leveraging federal funds to generate patents, and it is 10× more effective at creating cash returns on investment.

During the 2014 to 2018 period, $262 million went to photonics-related projects under the STTR program. This program was established in 1992 specifically to encourage joint ventures between small businesses and nonprofit research institutions, with the goal of achieving technology transfer (see STTR sidebar).

Overdependency

While Craig acknowledged SBIR and STTR are good ways to “weather the storm” from downturns in the economy, he warned, “One of the biggest challenges is photonics startups become too dependent on government business models. That’s sustainable but not a vehicle to sustain growth.” In Bozeman, Blackmore Sensors and Analytics has emerged as a poster child for breaking that overdependency. For several years it had secured lidar-related SBIR and STTR funds from the Department of Defense. But then Blackmore used venture capital to help it pivot and pitch its frequency-modulated continuous-wave (FMCW) lidar to the autonomous vehicle industry, and it was acquired last year by Aurora, an Amazon-backed self-driving startup.

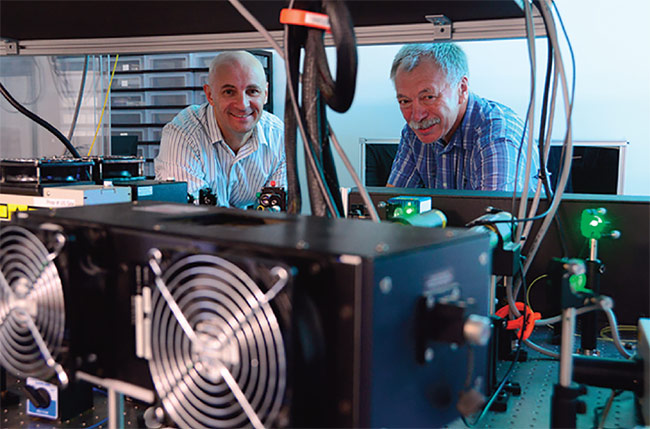

OptiGrate President Alexei Glebov (left) and professor Leonid Glebov of the University of Central Florida’s College of Optics and Photonics (CREOL). OptiGrate is an example of academic-industrial collaboration; it’s a company that began with a CREOL faculty member and technology licensed from the university.

OptiGrate pioneered commercial volume Bragg gratings (VBGs) from photo-thermo-refractive glass

and was acquired by IPG Photonics in 2017. Between 2000 and 2017, OptiGrate received 23 SBIR grants totaling $7.1 million, and eight STTR grants totaling $1.9 million, according to SBIR.gov. Courtesy of University of Central Florida.

“Our most successful startups tend to pursue some SBIR/STTR after they have received some seed investment,” said Scott Catlin, the associate vice president of technology ventures at the University of Rochester. “The most successful ones do not rely solely on SBIR/STTR, but rather use SBIR/STTR as additional nondilutive funding for ongoing research where possible.”

Initiatives

While the scientifically complex, time-consuming, and resource-intensive nature of photonics R&D does pose challenges for university-related startups, new state and federal initiatives are emerging to provide a bridge to commercialization. The Luminate accelerator in Rochester, N.Y., for example, is exclusively focused on photonics startups and assists company founders with balancing the readiness of their technology with their business requirements. Since its establishment in 2017, Luminate has had 20 companies complete the program, and 10 more are currently in it. It has created approximately 60 jobs, and $6.2 million in capital has been deployed. Another initiative

is MSU’s CATalyst Gap Fund Awards, which are supported by the U.S. Economic Development Administration.

VPG Medical is a Luminate NY startup that uses a mobile dice camera to monitor subtle changes in skin color to measure cardiac activity. VPG Medical’s CEO and its chief medical officer are assistant professors at the University of Rochester. Last year the company won $500,000 in funding at Luminate’s Demo Day competition. Courtesy of Luminate NY.

“University startups are at a very early stage,” said Sujatha Ramanujan, the managing director of Luminate.

“The commercialization path can be long and arduous. By taking technology straight out of a university, the investors are taking responsibility for developing the technology to be manufacturable, for ensuring the market is identified and addressed, and for making sure that the business is staffed with the correct skill set and that the entity itself functions like a business, not a research project. This is very high risk.”

STTR Smooths Path to Commercialization Through Collaboration

Congress created the Small Business Technology Transfer (STTR) program almost two decades ago to enable startups and other small businesses to more heavily leverage the research capabilities of universities and other nonprofit research institutions to develop innovations and commercialize them. Unlike the older Small Business Innovation Research (SBIR) program, which allows businesses to subcontract up to 30% of an award with a research institution or other research entity, the STTR increases that subcontracting limit to 60%.

While the SBIR.gov database does not include information on university subcontractors under the SBIR program, it does include the names of research institutions awarded STTR funding. Between 2014 and 2018, 367 small businesses* received 606 awards totaling $262 million in STTR funds for photonics-related projects**. Of that amount, 387 awards totaling $65.2 million went to Phase 1 proof-of-concept projects, and 219 awards totaling $196.8 million went to Phase 2 R&D projects. Data is not available for Phase 3 commercialization projects, which are usually made as contracts with federal agencies for goods or services.

“Many of the optics and photonics startups connected to the University of Central Florida begin with government funding through SBIR/STTR programs,” said Svetlana Shrom, director of the Office of Technology Commercialization at University of Central Florida. “These contracts provide new companies, which often have a former academic at the helm, with projects that have a research framework combined with a commercialization focus. It’s a great way to get started with a little bit of familiarity in the midst of the uncertainty of launching a company. Often, venture capital groups and even angel investors are looking for technologies that are closer to market. That’s especially tough for optics and photonics technologies that still require a lot of development.”often have a former academic at the helm, with projects that have a research framework combined with a commercialization focus. It’s a great way to get started with a little bit of familiarity in the midst of the uncertainty of launching a company. Often, venture capital groups and even angel investors are looking for technologies that are closer to market. That’s especially tough for optics and photonics technologies that still require a lot of development.”

Whereas nine federal agencies participate in the SBIR program, only five award STTR grants and contracts. More than half (53.9%) of the STTR funds for photonics-related projects came from the Department of Defense. Other STTR participating agencies include the Department of Energy (12.9%), the Department of Health and Human Services (17.2%), NASA (10.8%), and the National Science Foundation (5.3%).

Firms that receive Phase 1 proof-of-concept (usually up to $150,000) and Phase 2 R&D (usually up to $1 million) SBIR or STTR awards can see their projects funded for up to 2 1/2 to 3 years. That extended funding timeline, coupled with the robust research assets at research institutions, make these programs ideal for photonics startups. During the 2014 to 2018 period, photonics-related STTR awards for both phases totaled as much as $6.2 million for firms partnering with North Carolina State University, $6.5 million with Purdue University, and $8 million with the University of Arizona.

“Photonics technologies tend to be ‘deep,’ meaning there is a lot of difficult science and engineering involved,” said Daniel Juliano, the director of Montana State University’s technology transfer office. “They are less likely to be in a space where speed to market is crucial — as in consumer products and software apps. So a relatively small amount of capital, quickly delivered by VC, is less appropriate. They often require a larger amount of capital, delivered over years, which can be achieved through a series of SBIR/STTR topics.”

For years, the Small Business Technology Council has been attempting to increase the amount of funding research institutions receive under the STTR program. But that proposal, said the council’s executive director, Jere Glover, has met strong resistance from universities, many of which believe that “a dime that goes to the market is a dime that does not go to knowledge.”

“If you believe VCs are going to lead us out of this slow technology development,” he said, “that’s not us.”

* Firms with unique DUNS codes, which are unique nine-digit identifiers for businesses created by credit bureau Dun & Bradstreet.

** Photonics-related projects are those including any of the following terms in their title or summary: photonics, laser, spectral, spectroscopy, or optics.