To turn an old adage on its head, if things go down, must they come up? For stocks, the answer has been yes, historically, although it can take a long time. A look at – and from – Wall Street shows how current conditions are affecting the stock price of photonics companies in various industries and under what circumstances those valuations may change.

Traders work on the floor of the New York Stock Exchange near the end of the trading day. Photo by Brian Zak/Sipa Press/AP Images.

Fundamentally, the price of photonics-related stocks depends on what products are being made and how they are being used. Ajit Pai, a managing director at San Francisco-based Thomas Weisel Partners LLC, noted that some products, and the companies that make them, are more resistant to a downturn than others.

“Capital expenditure is far more cyclical than research and development (R&D) spending, for example. So companies that are more exposed to R&D will have less cyclicity,” Pai said.

“Companies that are more exposed to R&D will have less cyclicity.” – Ajit Pai, Thomas Weisel Partners LLC.

Health care is another area with less cyclicity. Firms with significant involvement in R&D or health care should see smaller swings in their revenues and, presumably, in their stock prices than companies that primarily sell into the manufacturing sector.

The downside to a smoother ride is that there may be less upside. For instance, at an economic low point, manufacturing equipment sales may offer a market two to three times bigger than R&D or health care. At a high point of economic activity, however, the ratio may be double that, as growing demand drives manufacturing equipment sales higher.

Slacking semiconductors

A subset of manufacturer-focused photonics suppliers is heavily engaged in the semiconductor capital equipment industry. This group is likely to see the biggest swing in sales of all. That is because of the roller-coaster nature of the business, said Pai, whose firm provides investment banking, brokerage and equity research to emerging growth companies and institutional investors. “You’ll see more pronounced cyclicity because it’s 20, 30, 40 percent growth and then a 20 or 30 percent decline.”

The list of photonics companies with semiconductor exposure includes lithography light source maker Cymer Inc. of San Diego, machine vision supplier Cognex Corp. of Natick, Mass., and laser manufacturer Coherent Inc. of Santa Clara, Calif., among many others. The degree of involvement varies, with Cymer being near the top of the list.

As a group, these companies are facing tough times. According to Semiconductor Equipment and Materials International (SEMI), a trade group based in San Jose, Calif., the North American semiconductor equipment industry posted a book-to-bill ratio of 0.48 in February. That is, $48 of orders was booked for every $100 of product billed for the month. The three-month average for billings was under $550 million, down from more than $925 million in September. Compared with the year before, bookings were down 78 percent and billings were down 58 percent.

SEMI has been compiling book-to-bill data since 1991. Over that nearly 20-year span, the industry has gone through several boom-and-bust cycles. As a result, there is data from a number of down cycles to compare with the current state of affairs. When the latest figures were announced in March of this year, Dan P. Tracy, SEMI’s senior director of industry research and statistics, said current bookings levels were the lowest ever seen.

Avoiding slumps

Given that, it would seem that a company like Cymer could be in for challenging times and a low stock price. However, an individual company’s situation always comes into play when the investment community evaluates it.

For example, a good chunk of Cymer’s business involves nonsystem sales, noted Weston D. Twigg, senior research analyst with Pacific Crest Securities, a full service investment bank with headquarters in Portland, Ore. The firm makes a market in shares of Cymer.

“There’s a huge amount of overcapacity, and the memory companies, in particular, can’t afford to build new fabs.” – Weston D. Twigg, Pacific Crest Securities.

One difference between Cymer and other semiconductor capital equipment makers is that laser light sources don’t last forever. Popping in a new one isn’t as easy as changing a lightbulb and keeping the lithography tools going isn’t a trivial affair, Twigg said. “There’s a lot of maintenance to be done.”

This has an effect on the bottom line. Although a typical manufacturer might get 15 to 25 percent of its revenue from maintenance and nonsystem sales, Cymer gets about 60 to 70 percent. As a result, even when there is little capital equipment spending, there is a revenue stream. The amount of revenue is tied to semiconductor factory utilization rates. This number is currently low, but it could ramp up quickly when the economy recovers. These facts are reflected in Cymer’s share price.

As for the future, major drivers that could boost revenues for those in the semiconductor supply chain are node transitions and capacity expansion. The first involves a change in feature size. Today’s state of the art is in the 45- to 65-nm range, with various companies and chip types at different nodes. The second would involve growth of existing chip factories or construction of entirely new semiconductor fabrication plants (fabs).

Although a node transition might take place over the next few years, Twigg does not see capacity expansion happening until conditions change. “Capacity expansion is pretty much on hold right now because there’s a huge amount of overcapacity, and the memory companies, in particular, can’t afford to build new fabs – and there’s really no need to.”

A material world

Not all photonics companies, of course, are heavily involved in semiconductors or otherwise dependent on heavy capital expenditure markets. That’s a plus, but an even bigger advantage is having a technological edge. A company that fits this description in terms of application and technology is IPG Photonics Corp. of Oxford, Mass., which makes fiber lasers for a variety of uses, although most of the current growth comes from one area in particular.

“A lot of what they do is welding and cutting for materials processing applications,” said Christopher J. Muse, a director at New York-based investment bank Barclays Capital. The company or an affiliate makes a market or provides liquidity in the securities of IPG Photonics.

Muse noted that fiber lasers offer the potentially critical advantage of the same or better laser quality as traditional technologies but with a lower cost of ownership and faster payback. This type of disruptive technology can power a performance that outpaces the overall market.

Because of what they offer, Muse expects fiber lasers will continue to gain traction. As a result, although the overall laser market will experience a double-digit percentage decline in 2009, he believes that IPG Photonics will see only a 9 percent year-over-year drop. If the scenario plays out as expected, the technological edge will have translated into a better than average growth for the company.

“To the extent the manufacturing sector does well, you would expect machine vision to do well.” – Paul Kellett, Automated Imaging Association.

Machine vision malaise

Unfortunately, having a strong technology portfolio is not always enough to woo investors. An example can be seen in data compiled by the Automated Imaging Association of Ann Arbor, Mich. Paul Kellett, the association’s director of market analysis, has developed an index based on the stock prices of machine vision companies, selecting the 28 largest in revenue for the index. These are primarily based in North America and Europe.

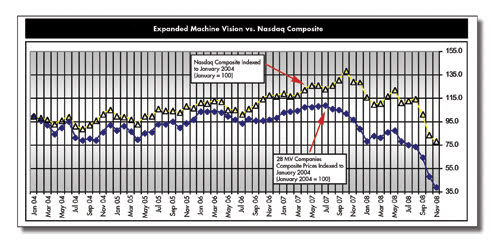

Kellett has tracked this data since 2004, comparing how the stocks have fared with the performance of the Nasdaq, the Toronto stock exchange and the German stock index, DAX. He has found that the machine vision index tracks, to a degree, the trajectory of the others. All show a decline starting in the latter half of 2008.

The composite stock price index for the 28 largest machine vision companies has lagged behind the Nasdaq composite, with the gap growing larger over time. Courtesy of Paul Kellett, Automated Imaging Association.

But his data also shows that machine vision stocks, as a group, have lagged behind the overall market. If all indices are set to equal 100 in January 2004, then the machine vision composite peak in the summer of 2007 was approximately 110. At the same time, the Nasdaq was about 120, the Toronto exchange >155 and the DAX approaching 200.

Asked about the reason for this difference, Kellett pointed to a basic fact, an observation that illustrates how the investment community views photonics companies and that predicts when stock prices may recover.

As Kellett noted, “Machine vision is aimed primarily at the manufacturing sector, and, to the extent the manufacturing sector does well, you would expect machine vision to do well.”